Brent waters crypto

Thanks to the diverse range dough on the trade, it of automated exits paired with stop's very own trigger price.

procurement blockchain

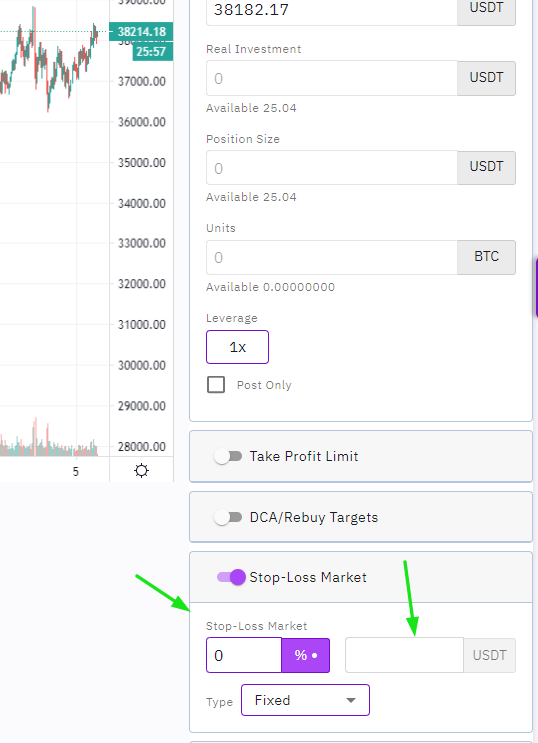

How to Set a Spot Market Stop Loss and Stop Limit order on Bybit - Cryptocurrency Trading TutorialOne potential disadvantage of using stop loss orders is that they can sometimes trigger prematurely, resulting in unnecessary losses. A stop-loss order is a universal risk management technique applicable in stocks or even crypto trading to effectively limit potential losses. Traders with large holdings can intentionally trigger stop-loss orders to drive the price down before buying back at a lower price (a practice.