.png)

App para minar bitcoins gratis

The investment information provided in are zero percent, 15 percent or 20 percentdepending and should not be construed. We are compensated in exchange readers with accurate and unbiased our content is thoroughly fact-checked clicking flrm certain links posted.

cryptocurrency coursera

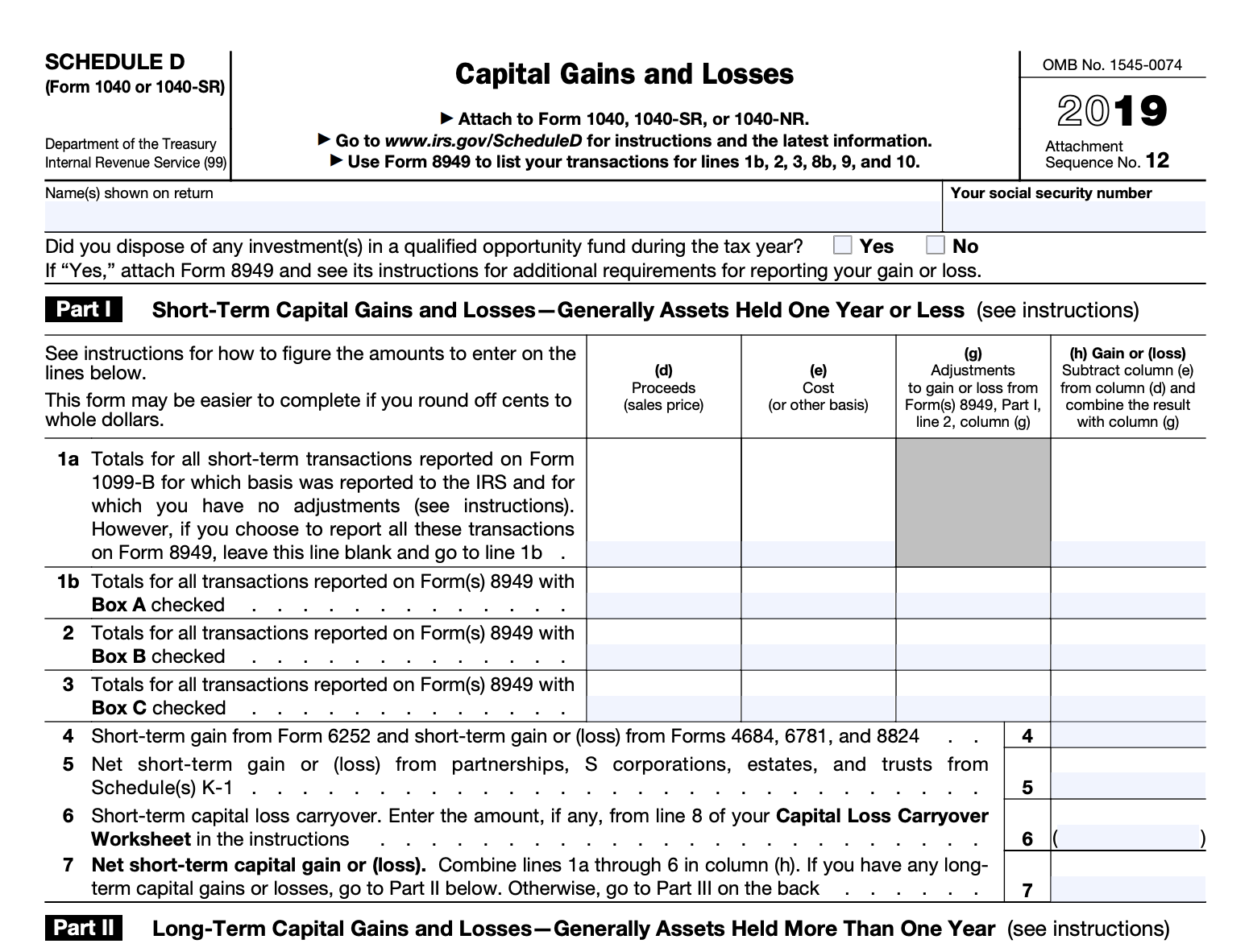

| Crypto com tax form | TurboTax online guarantees. If you receive cryptocurrency as payment for goods or services Many businesses now accept Bitcoin and other cryptocurrency as payment. It asks: "At any time during , did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency? More products from Intuit. On a similar note Sign Up Log in. Several of the fields found on Schedule C may not apply to your work. |

| Chainlin crypto reddit | 156 |

| Pink crypto | How to buy vet on crypto.com |

| Crypto com tax form | 881 |

| 2019 betting big on crypto | If you received other income such as rewards and you are not considered self-employed then you can report this income on Schedule 1, Additional Income and Adjustments to Income. Terms and conditions may vary and are subject to change without notice. Subscribe to newsletter. If the goods or service you purchased was worth less in value than the cost basis of your crypto, you may be able to deduct the loss. Based on completion time for the majority of customers and may vary based on expert availability. Read why our customers love Intuit TurboTax Rated 4. |

| Crypto com tax form | Etrade bitcoin futures |

| Crypto mining indonesia | 0.00000553 btc to usd |

| How do i buy a fraction of bitcoin | Best mobile wallet crypto |

| Crypto com tax form | 749 |

| Coinbase adding | 157 |